The Child Tax Credit Update Portal currently lets families see their eligibility manage their payments and unenroll from the advance monthly payments. Having Trouble Accessing the Child Tax Credit Portal.

August Child Tax Credit Here S How To Get The Right Stimulus Check Payment Next Month If Yours Fell Short In July

The Child Tax Credit Update Portal currently lets families see their eligibility manage their payments and unenroll from the advance monthly payments.

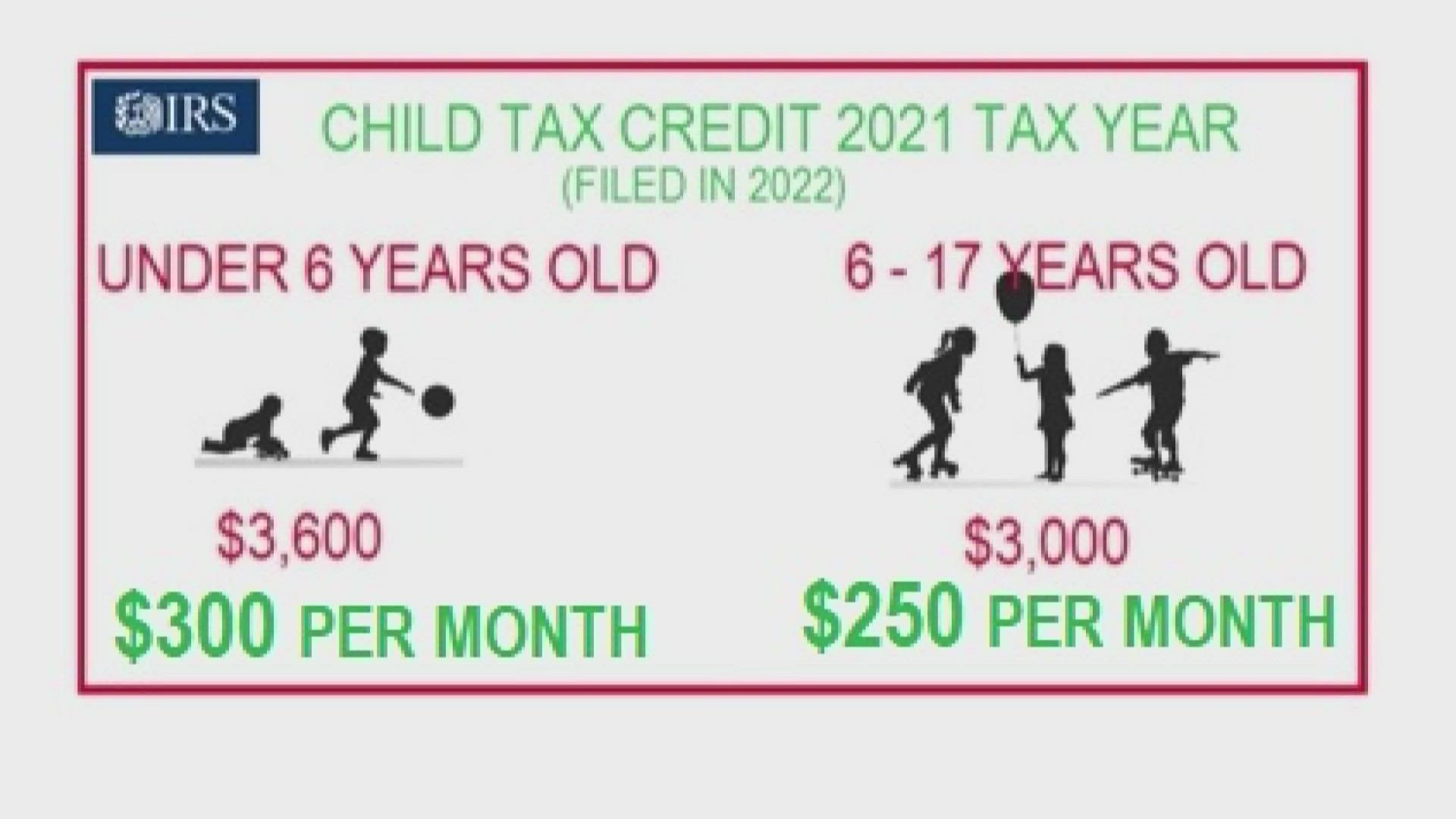

Child tax credit portal. The child tax credit is 3600 annually for children under age 6 and 3000 for children ages 6 to 17Eligible families will receive 300 monthly for each child under 6 and 250 per older child. The Child Tax Credit Update Portal will allow taxpayers to report any change in status dependents income throughout the year. Parents can also update their direct deposit.

The Child Tax Credit Update Portal now also allows users to add or modify bank account information for direct deposit. The tax agency has been under enormous strain since the start of the pandemic to distribute additional support in the form of stimulus checks and the new Child Tax Credit. These families will be able to use the portal.

Eligible families receive 300 per month for children under the age of 6 and 250 per month for children older. The second round of child tax credit payments due to millions of American families are going out Friday totaling more than 15 billion. Parents may also use the online portal to elect out of the advance payments or check on the.

Parents just have to update their details on the IRS Child Tax Credit portal. Unlike in previous years the new credit also allows families with extremely low or no income to qualify for the entire benefit. Half the total credit amount will be paid in advance monthly payments and you will claim the other half when you file your 2021 income tax return.

Families will receive another five payments before the end of the year and the remaining amount is claimed when tax returns are filed in 2022. The tax credit will allow for up to 3600 per child for children under 6 years of age before the. How To Use The Child Tax Credit Direct Deposit Portal.

Using the IRSs child tax credit update portal taxpayers can update their information to reflect any new information that might impact their child tax credit amount such as filing status or number of children. Important changes to the Child Tax Credit will help many families get advance payments of the Child Tax Credit starting in the summer of 2021. It also lets recipients see their.

That signifies that as an alternative of receiving month-to-month funds of say 300 to your 4-year-old you may wait till submitting a 2021 tax return in 2022 to obtain the 3600 lump sum. The Child Tax Credit Update Portal allows users to make sure they are registered to receive advance payments. The second round of the advance monthly payments of the child tax credit hit bank accounts through direct deposit on August 13.

That means that instead of receiving monthly payments of say 300 for your 4. The updated information will apply to the August payment and those after it. Parents can also update their direct deposit.

The 2021 child tax credit provides parents with up to 3600 per child for kids under 6 and 3000 for all other children under 18 with half of the money being doled out as monthly payments that started this week. IRSs child tax credit update portal. The Child Tax Credit Update Portal now permits you to opt out of receiving this 12 monthss month-to-month little one tax credit funds.

That means that instead of receiving monthly payments of say 300 for your 4. Kids born on or up to December 31 will receive the full tax credit. The Child Tax Credit Update Portal now lets you opt out of receiving this years monthly child tax credit payments.

The first a Child Tax Credit Update Portal allows families to check if they qualify for the credit and also gives them a choice of opting out of receiving any payments this year. Payments are made from the 15th to December of each month but since August 15th is a weekend payments have been raised to Friday. The Child Tax Credit Update Portal now lets you opt out of receiving this years monthly child tax credit payments.

Child Tax Credit Update Portal. Child tax credit is 3600 per year for children under 6 years old Children 6 to 17 years old.

Covid Related Tax Credits Available To Nonprofit Employers National Council Of Nonprofits

Low Income Housing Tax Credit Ihda

Reducing Child Poverty By Expanding Child Tax Credits Whyy

Irs Ctc How Do I Access The Irs Child Tax Credit Update Portal Ctc Up Id Me Support

Child Tax Credit Opt Out When Is The Deadline Wfla

Digital Services Dealing With Your Tax And Tax Credits Online Low Incomes Tax Reform Group

Advance Child Tax Credit Payments Going Out This Week Nbc 5 Dallas Fort Worth

Child Tax Credit Checks Will They Become Permanent Wgn Tv

Child Tax Credit 2021 This Irs Portal Is The Key To Opting Out And Updating Your Information Cnet

What To Know About New Child Tax Credits Starting In July Nbc 5 Dallas Fort Worth

Child Tax Credit Monday Is The Deadline To Pick One Big Payment Over A Monthly Check Whnt Com

Here S What To Know As The Irs Starts Distributing Child Tax Credits This Week

Child Tax Credit How To Opt Out Of Monthly Payments For One Payout

Advance Child Tax Credit Advctc Payments In July 2021

YOU MAY LIKE :